FUTURE-PROOF

DIGITAL BANKING.

BUILDING THE DIGITAL BANKING PLATFORM TAILOR-MADE TO YOUR NEEDS

#MULTIBANKING

#HUMAN-CENTERED BANKING

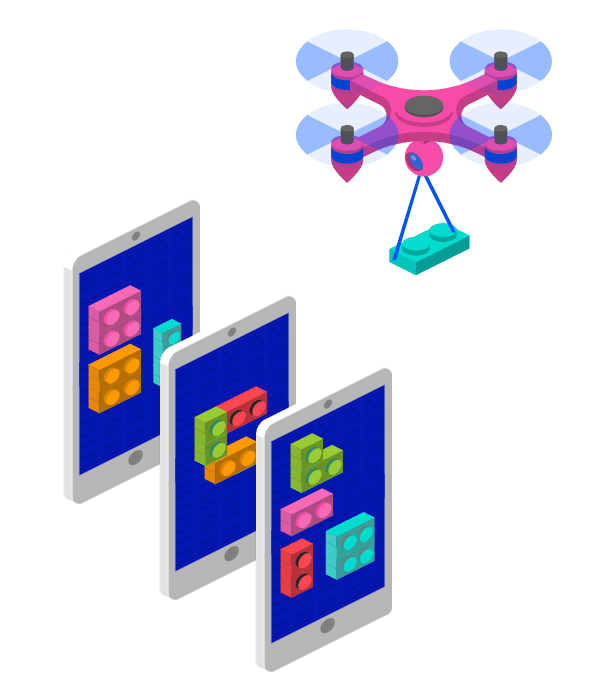

#LET YOUR CUSTOMERS BUILD THEIR OWN FINANCIAL APP

#CLOUD BANKING

#PLUG&PLAY BANKING EXPERIENCE

#OPEN-BANKING-AS-A-SERVICE

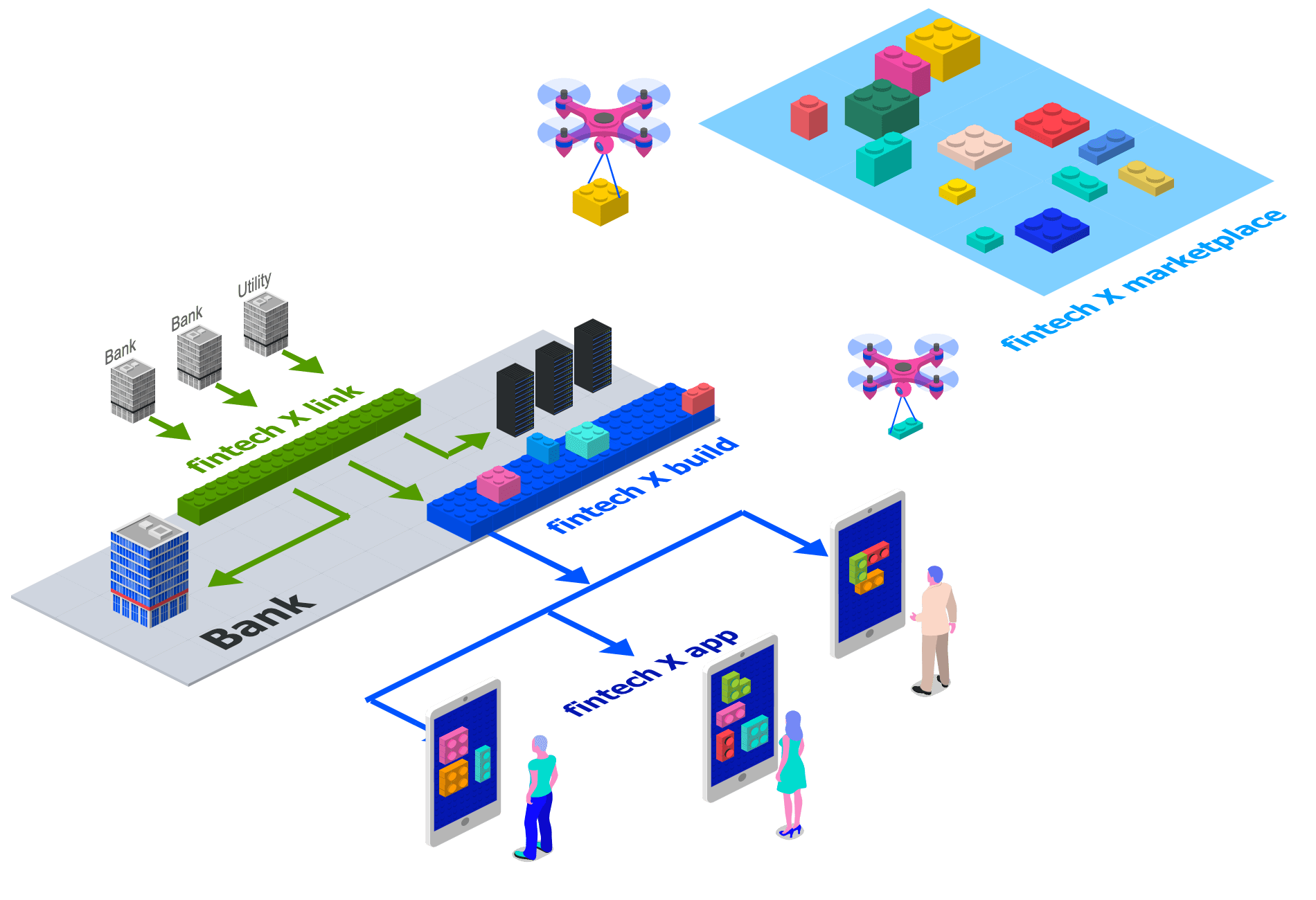

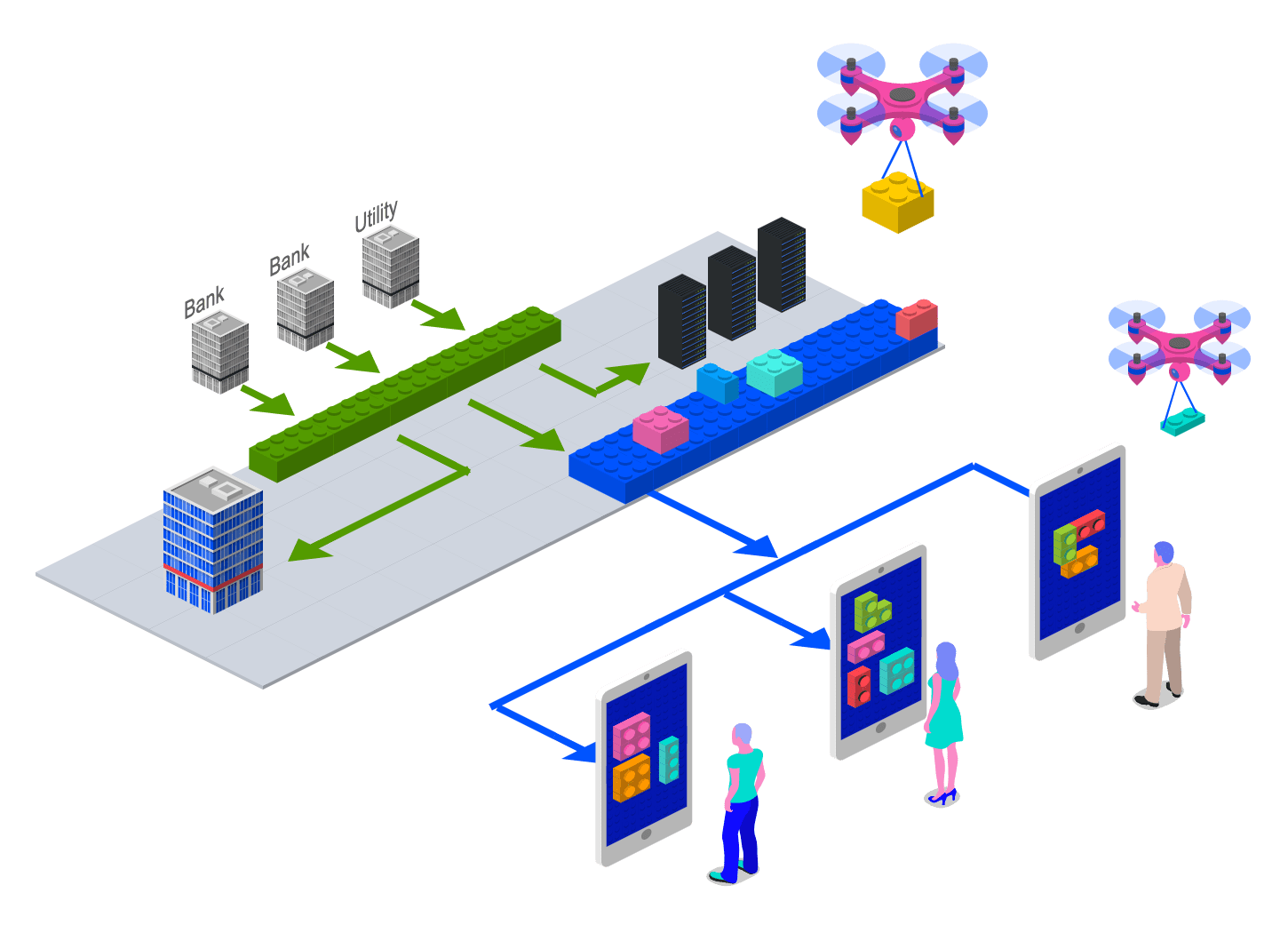

FINTECHX SOLUTIONS IN THE FULL SPECTRUM OF OPEN BANKING.

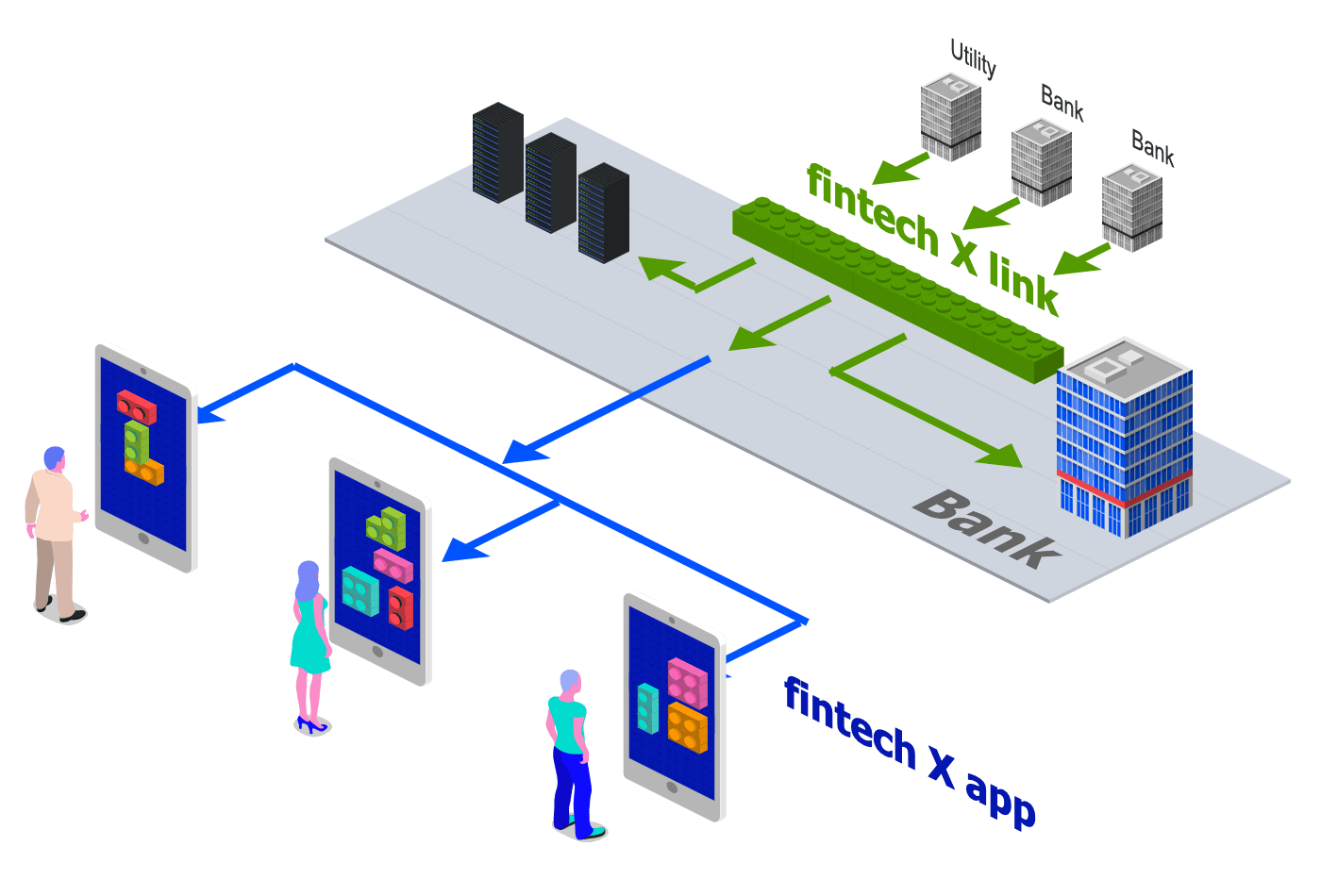

FintechX app

FintechX link

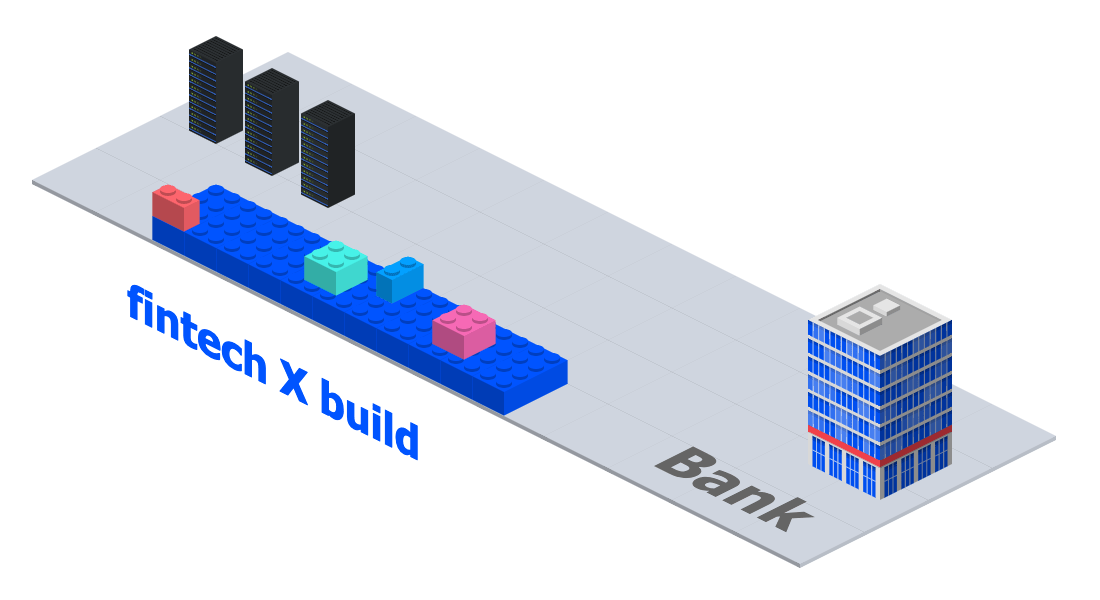

FintechX build

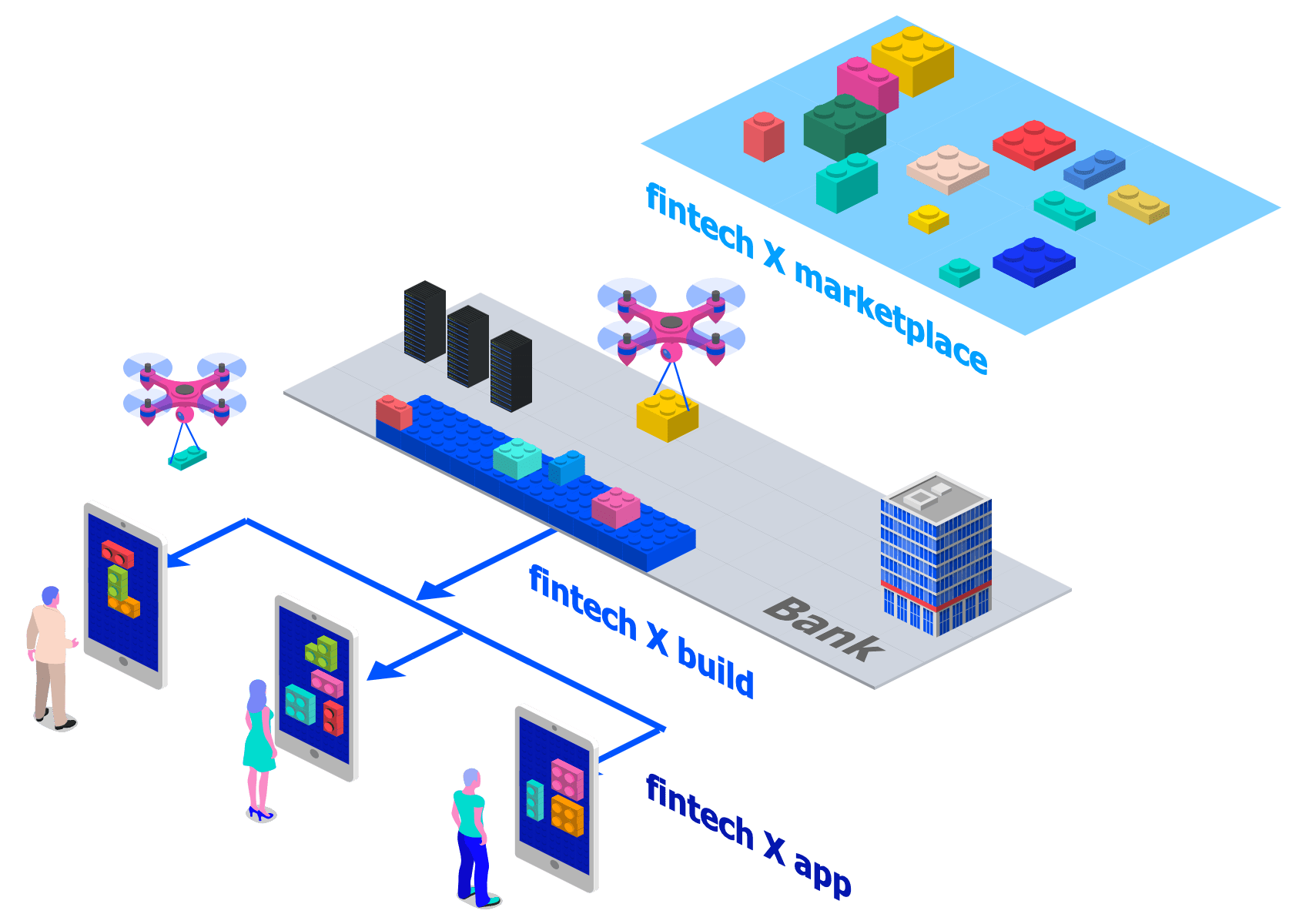

FintechX marketplace

Offers pre-integrated fintech solutions that can be implemented into FintechX app and FintechX build with just 3-clicks.

LEADING TO FUTURE FINANCES.

#1

CUSTOMER DRIVEN BANKING

THE QUESTIONS AROUND BANKING ARE CHANGING. SOON YOU WILL ASK YOUR CUSTOMERS WHICH MOBILE APP THEY USE TO MANAGE THEIR FINANCES, RATHER THAN WHICH BANK HAS THEIR ACCOUNT.

CUSTOMER NEEDS ARE CHANGING

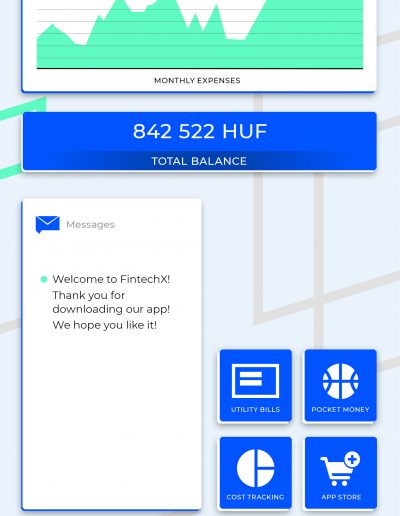

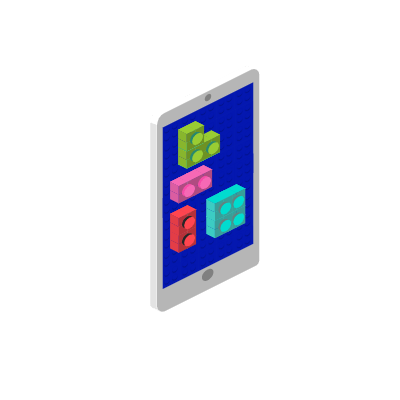

More customers want the flexibility to compose for themselves the financial services they use within one single mobile app.

The customers want a single customizable mobile app they can adjust to their own needs, regardless how many banks they have accounts at, or how many financial service providers they have loans, savings, securities accounts at.

EXPAND MARKET REACH

Those financial service providers can strengthen their customer acquisition and sales capabilities, that offer multibanking access to financial services that meet the customer needs based on their life situation, at the right time.

The customer-retention power of user-driven solutions fully customizable by the consumer will rise in the medium term. These kinds of solutions will thus become the essential tool for controlling the primary user touchpoints.

FINTECHX SOLUTIONS

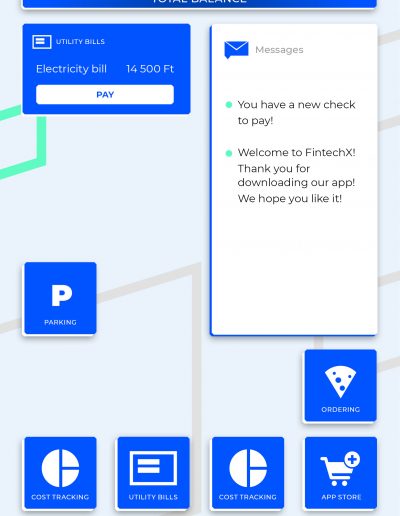

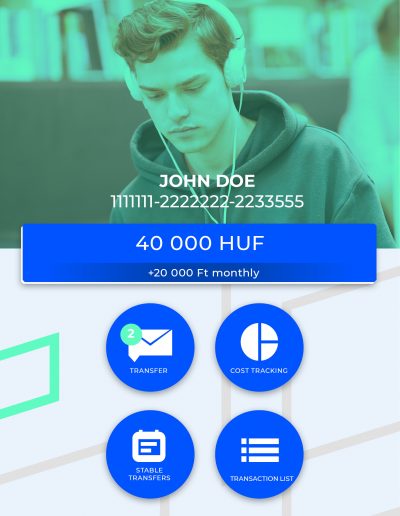

FintechX app is a mobile solution empowering (financial) service providers to offer a whole range of customizable services, thus creating the world of customer-driven financial services.

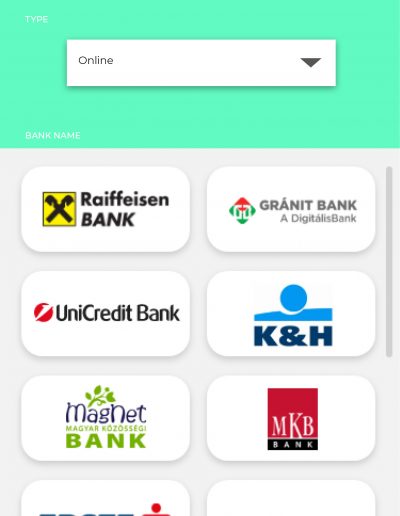

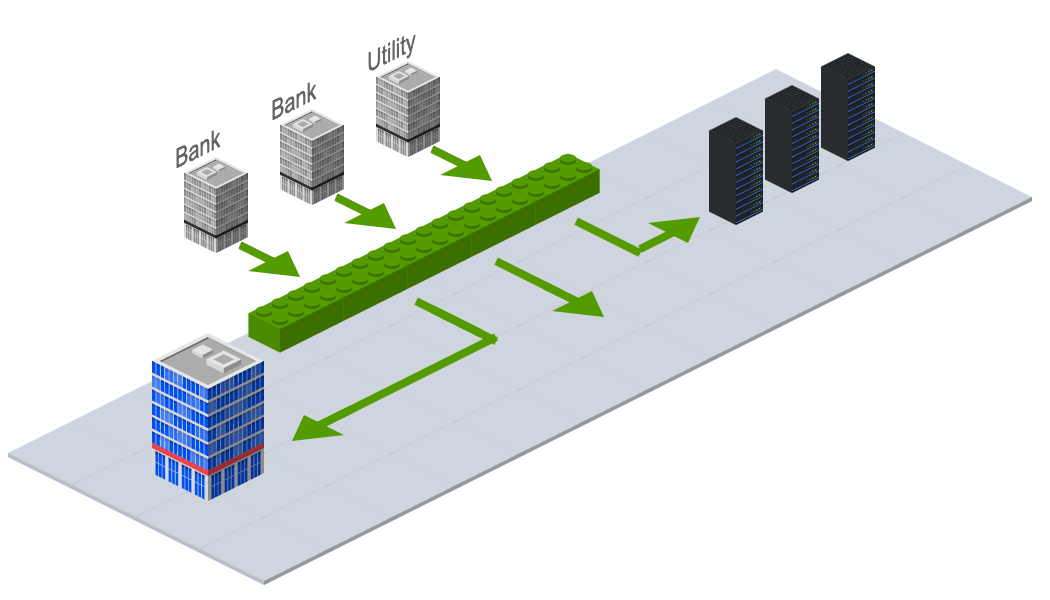

Moreover, FintechX link provides access to their customers’ account information and utility data, which they can use to build account information and payment initiation services on top.

We offer a mobile application that can be quickly expanded with fintech apps and a PSD2-compliant API aggregation.

#2

ACCELERATE INNOVATION

OUR SOLUTION ENABLES TWO-SPEED IT OPERATIONS TO REDUCE THE TIMEFRAME FOR DEVELOPING AND LAUNCHING NEW DIGITAL SERVICES BY UP TO 80 %.

ENABLE TWO-SPEED IT

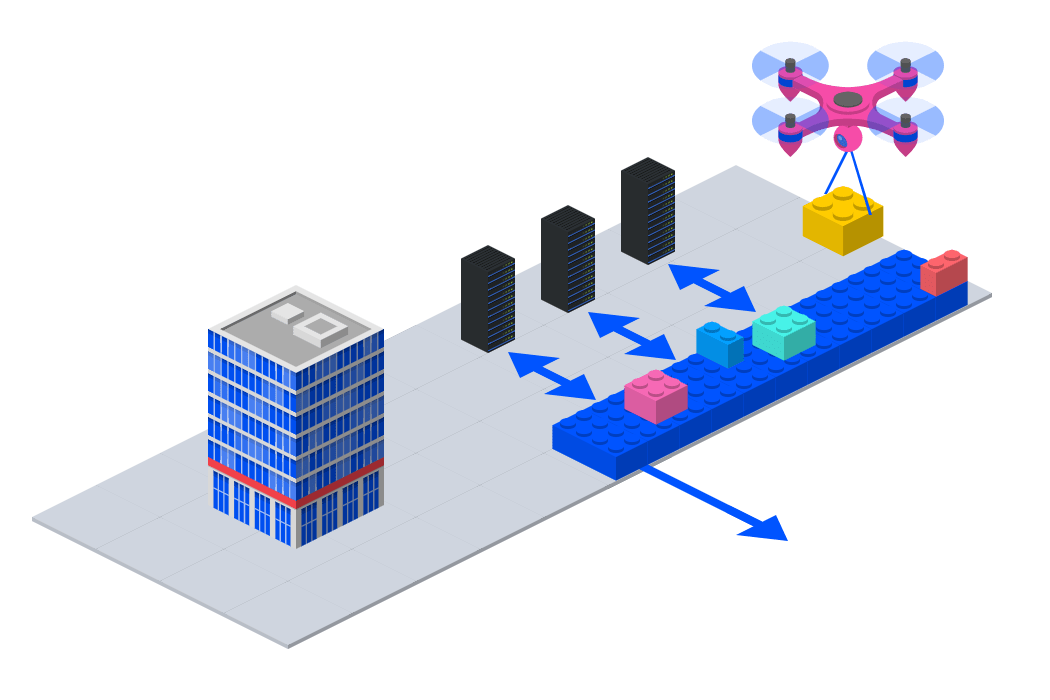

FintechX build creates a flexibly scalable development and operations environment for the banks, financial and business service providers to accelerate their innovation capabilities without affecting their core systems.

OPTIMIZE RESOURCES

Financial service providers using FintechX build solution can significantly increase their innovation speed, thus shortening the time-to-market of their new digital services up to 70-80 % due to radical decrease of the resources required to comply with regulations.

Unlike the silo-like solutions, FintechX build is a distributed architecture environment that also provides an effective tool to optimize infrastructure costs.

FINTECHX SOLUTIONS

FintechX build employs cutting-edge technologies, meets the leading EU open banking API standards. Its platform approach enables plug&play-like bank-fintech integration.

#3

BUILD A FUTURE-PROOF BANK

NEW FINTECH SOLUTIONS

WITH UP TO 3 CLICKS.

CUSTOMIZABLE SOLUTIONS ARE

THE KEY TO FUTURE-PROOF BANKING.

FAST INTRODUCTION IS IMPERATIVE TO STAY IN THE GAME.

NEW GROWTH STRATEGY

In the medium term, staying in the race calls for increasing the innovation and integration speed in addition to the efficient use of resources.

Continued renewal and fast introduction of fintech solutions raises customer value and supports the implementation of the new growth strategy.

IN-HOUSE INNOVATION

New ideas can come from outside and from within the organization. Development environments and applications that enable implementation of bottom-up ideas and facilitate rapid distribution of innovative solutions among the subsidiaries are key to improving the power of in-house innovation.

FINTECHX SOLUTIONS

FintechX app, FintechX build and the FintechX marketplace altogether provides an integrated and composable tool that ensures the ability of staying in the race and of constant renewal.

Having integrated FintechX build, the financial service providers that use FintechX app can add FintechX marketplace solutions to their services with up to 3 clicks.

FintechX build facilitates introduction of further new services within up to 1 month and can be offered to retail and business customers immediately via the FintechX app.

BUILT FOR YOU.

#1 FintechX app

#2 FintechX link

#3 FintechX build

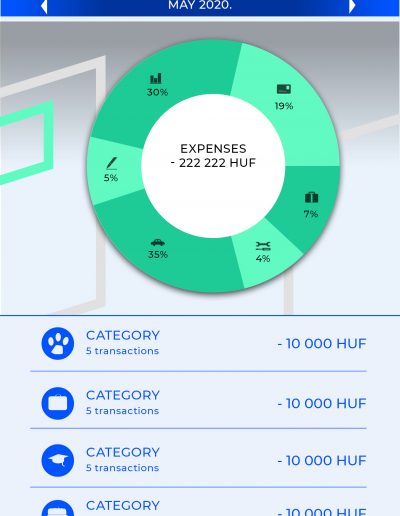

#1 FintechX app

MOBILE EXPERIENCE FULLY CUSTOMIZABLE BY THE CUSTOMER

#PLUG&PLAY BANKING EXPERIENCE

#CUSTOMER DRIVEN BANKING

#HUMAN-CENTERED BANKING

#2 FintechX link

INCREASE CUSTOMER ACQUISITION AND SALES CAPABILITIES

#MULTIBANKING

#OPEN-BANKING-AS-A-SERVICE

#3 FintechX build

ACCELERATE INNOVATION

#CLOUD BANKING

#FROM-PRIVATE-TO-PUBLIC CLOUD

#KÉTSEBESSÉGES IT

REFERENCES.

WE WORK FOR:

Having merged three projects (Wyze, Aggreg8, FintechBlocks) of Wyze Startup Studio, FintechX Technologies Ltd. was registered in December, 2019. These three ventures enabled FintechX to offer a full spectrum of open banking services.